UPDATE: Medicare officials are delaying the mail out of the new Medicare cards to ramp up…

2017 Medicare Parts A & B Premiums and Deductibles Announced

Date: 2016-11-10

Date: 2016-11-10

Title: 2017 Medicare Parts A & B Premiums and Deductibles Announced

Contact: press@cms.hhs.gov

2017 Medicare Parts A & B Premiums and Deductibles Announced

Today, the Centers for Medicare & Medicaid Services (CMS) announced the 2017 premiums for the Medicare inpatient hospital (Part A) and physician and outpatient hospital services (Part B) programs.

Medicare Part B Premiums/Deductibles

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and other items.

On October 18, 2016, the Social Security Administration announced that the cost-of-living adjustment (COLA) for Social Security benefits will be 0.3 percent for 2017. Because of the low Social Security COLA, a statutory “hold harmless” provision designed to protect seniors, will largely prevent Part B premiums from increasing for about 70 percent of beneficiaries. Among this group, the average 2017 premium will be about $109.00, compared to $104.90 for the past four years.

For the remaining roughly 30 percent of beneficiaries, the standard monthly premium for Medicare Part B will be $134.00 for 2017, a 10 percent increase from the 2016 premium of $121.80. Because of the “hold harmless” provision covering the other 70 percent of beneficiaries, premiums for the remaining 30 percent must cover most of the increase in Medicare costs for 2017 for all beneficiaries. This year, as in the past, the Secretary has exercised her statutory authority to mitigate projected premium increases for these beneficiaries, while continuing to maintain a prudent level of reserves to protect against unexpected costs. The Department of Health and Human Services (HHS) will work with Congress as it explores budget-neutral solutions to challenges created by the “hold harmless” provision.

“Medicare’s top priority is to ensure that beneficiaries have affordable access to the care they need,” said CMS Acting Administrator Andy Slavitt. “We will continue our efforts to improve affordability, access, and quality in Medicare.”

Medicare Part B beneficiaries not subject to the “hold harmless” provision include beneficiaries who do not receive Social Security benefits, those who enroll in Part B for the first time in 2017, those who are directly billed for their Part B premium, those who are dually eligible for Medicaid and have their premium paid by state Medicaid agencies, and those who pay an income-related premium. These groups represent approximately 30 percent of total Part B beneficiaries.

CMS also announced that the annual deductible for all Medicare Part B beneficiaries will be $183 in 2017 (compared to $166 in 2016). Premiums and deductibles for Medicare Advantage and prescription drug plans are already finalized and are unaffected by this announcement.

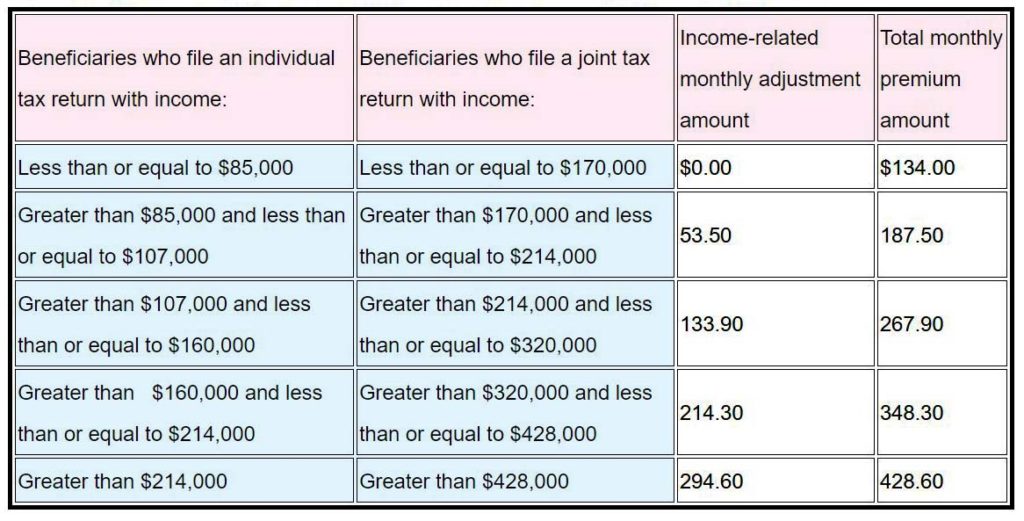

Since 2007, beneficiaries with higher incomes have paid higher Medicare Part B monthly premiums. These income-related monthly premium rates affect roughly five percent of people with Medicare. The total Medicare Part B premiums for high income beneficiaries for 2017 are shown in the following table:

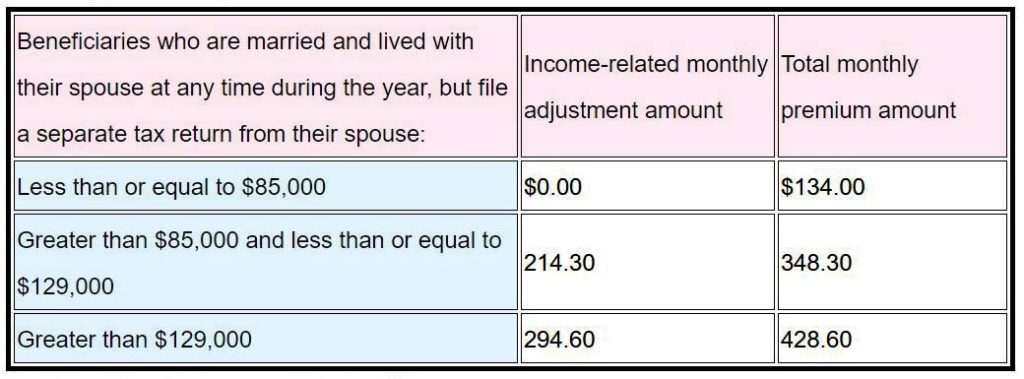

Premiums for beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows:

Medicare Part A Premiums/Deductibles

Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment.

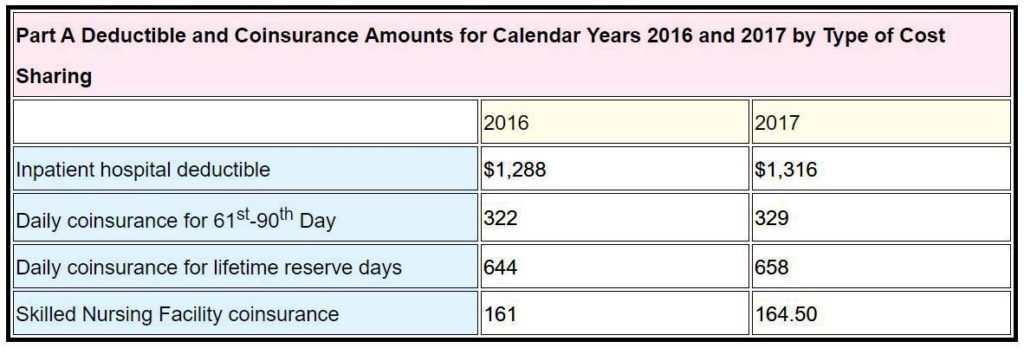

The Medicare Part A inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,316 per benefit period in 2017, an increase of $28 from $1,288 in 2016. The Part A deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period. Beneficiaries must pay a coinsurance amount of $329 per day for the 61st through 90th day of hospitalization ($322 in 2016) in a benefit period and $658 per day for lifetime reserve days ($644 in in 2016). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in a benefit period will be $164.50 in 2017 ($161 in 2016).

Enrollees age 65 and over who have fewer than 40 quarters of coverage and certain persons with disabilities pay a monthly premium in order to receive coverage under Medicare Part A. Individuals who had at least 30 quarters of coverage or were married to someone with at least 30 quarters of coverage may buy into Part A at a reduced monthly premium rate, which will be $227 in 2017, a $1 increase from 2016. Uninsured aged and certain individuals with disabilities who have exhausted other entitlement and who have less than 30 quarters of coverage will pay the full premium, which will be $413 a month, a $2 increase from 2016.

For more information on the 2017 Medicare Parts A and B premiums and deductibles (CMS-8062-N, CMS-8063-N, CMS-8064-N), please visit https://www.federalregister.gov/public-inspection.